Some businesses with a high volume or those that work in industries where the risk of fraud is high may reconcile their bank statements more often (sometimes even daily). An account reconciliation is usually done for all asset, liability, and equity accounts, since their account balances may continue on for many years. It is less common to reconcile a revenue or expense account, since the account balances are flushed out at the end of each fiscal year. However, this may be done simply to verify that transactions were recorded in the correct account; a reconciliation may reveal that a transaction should be shifted into a different account. The objective of doing reconciliations to make sure that the internal cash register agrees with the bank statement. Once any differences have been identified and rectified, both internal and external records should be equal in order to demonstrate good financial health.

Adjust the Bank Statements

Reconciliation substantiates the accuracy of financial reporting by comparing internal records against external documentation, dividend payable dividend payable vs dividend declared such as bank statements, to identify and correct any inconsistencies. This includes bank reconciliation for the cash account and ensuring all transactions are posted correctly within the chart of accounts. As financial statements are built upon these underlying balances, the integrity of the reporting process hinges on meticulous reconciliation to prevent balance sheet errors and misstatements. Companies prepare bank reconciliation statements as a comprehensive accounting comparison tool. A company can ensure that all payments have been processed accurately by comparing their internal financial records against their bank account balance.

A company may issue a check and record the transaction as a cash deduction in the cash register, but it may take some time before the check is presented to the bank. In such an instance, the transaction does not appear in the bank statement until the check has been presented and accepted by the bank. For example, a company maintains a record of all the receipts for purchases made to make sure that the money incurred is going to the right avenues. When conducting a reconciliation at the end of the month, the accountant noticed that the company was charged ten times for a transaction that was not in the cash book. Automating your account reconciliation process doesn’t mean that you can dismiss your accounting team overnight or improve efficiencies twofold immediately. Setting realistic expectations for AI implementation is key to understanding your ROI on AI spending.

- Or the payment you made to supplier A went into the accounts of supplier B due to a clerical error.

- This can include large payments and deposits or notifications of suspicious activity from your bank.

- Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth.

- It ensures that financial records, such as balance sheets and income statements, are free from errors and discrepancies.

- Documenting all communications is critical for resolving such issues and maintaining the integrity of financial records.

What role does a bookkeeper play in the process of account reconciliation?

It ensures that financial records, such as balance sheets and income statements, are free from errors and discrepancies. Reconciliation refers to the process of verifying that the balance in one’s accounting records (the “book balance”) aligns with the corresponding balance provided by an external source, such as a bank statement. Most importantly, reconciling your bank statements helps you catch fraud before it’s too late. It’s important to keep in mind that consumers have more protections under federal law in terms of their bank accounts than businesses.

And generating financial reports in Clio Accounting is a breeze, making your life, and your accountant’s life that much easier. This reconciliation process allows you to confirm that the records being compared are complete, accurate, and consistent. Reconciliation ensures that accounting records are accurate, by detecting bookkeeping errors and fraudulent transactions. The differences may sometimes be acceptable due to the timing of payments and deposits, but any unexplained differences may point to potential theft or misuse of funds. Reconciling an account is an accounting process that is used to ensure that the transactions in a company’s financial records are consistent with independent third party reports.

Gathering Necessary Documents

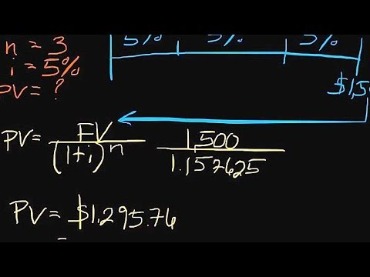

One of the most common causes of discrepancies in bank reconciliations is delays in deposit and transaction processing. Checks sent or received at the end of the day, or toward the end of the month, may be subject to delay which will prevent them from being included on the bank statement. Accounting for these delays is key to reconciling the total amounts on the company’s financial statement and the bank statement. Some bank services, including expedited payments, bank drafts, and in some cases paper bank statements, may come with additional bank fees. If a company is unaware of the exact amount of these fees, they may not be included in the company’s financial records and will only be seen when they receive their bank statement.

Adjustments to the Cash Account

The more frequently you do a bank reconciliation, the easier what is notes payable definition how to record and examples it is to catch any errors. Many companies may choose to do additional bank reconciliations in situations that involve large sums of money or that show unusual financial activity. This can include large payments and deposits or notifications of suspicious activity from your bank. A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank.

The reconciliation statement thus is essential for identifying discrepancies between the two records. Reconciling your bank statements simply means comparing your internal financial records against the records provided to you by your bank. This process is important because it ensures that you can identify any unusual transactions caused by fraud or accounting errors. As a business, the practice can also help you manage your cash flow and spot any inefficiencies. Account reconciliation is the process of cross-checking a company’s financial records, like the general ledger (GL) and sub-ledgers (SL), with external documents, such as bank statements.

Conversely, identify any charges appearing in the bank statement but examples of inherent risk that have not been captured in the internal cash register. Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc. The charges have already been recorded by the bank, but the company does not know about them until the bank statement has been received. Financial professionals must be vigilant in identifying and correcting discrepancies due to bank errors, accounting mistakes, and instances of fraud and theft.

It not only allows you to protect your clients’ funds, but your firm too as a result. A bank error is an incorrect debit or credit on the bank statement of a check or deposit recorded in the wrong account. Bank errors are infrequent, but the company should contact the bank immediately to report the errors. The correction will appear in the future bank statement, but an adjustment is required in the current period’s bank reconciliation to reconcile the discrepancy. As the end of the month approaches, accountants’ can often be found buried deep in financial books and countless receipts and invoices.