While there are plenty of profitability metrics—ranging from the gross margin down to the net profit margin—the contribution margin metric stands out for the analysis of a specific product or service. The contribution margin (CM) is the profit generated once variable costs have been deducted from revenue. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. If the contribution margin for an ink pen is higher than that of a ball pen, the former will be given production preference owing to its higher profitability potential. Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs.

Contribution Margin Per Unit Formula:

This $60 represents your product’s contribution to covering your fixed costs (rent, salaries, utilities) and generating a profit. All you have to do is multiply both the selling price per unit and the variable costs per unit by the number of units you sell, and then subtract the total variable costs from the total selling revenue. Contribution margin ratio is a calculation of how much revenue your business generates from selling its products or services, once the variable costs involved in producing and delivering them are paid. This can be a valuable tool for understanding how to price your products to ensure your business can pay its fixed costs, such as salaries and office rent, and still generate a profit. This demonstrates that, for every Cardinal model they sell, they will have \(\$60\) to contribute toward covering fixed costs and, if there is any left, toward profit. Every product that a company manufactures or every service a company provides will have a unique contribution margin per unit.

Formula and Calculation of Contribution Margin

This is the only real way to determine whether your company is profitable in the short and long term and if you need to make widespread changes to your profit models. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs. For example, raising prices increases contribution margin in the short term, but it could also lead to lower sales volume in the long run if buyers are unhappy about it. Before making any changes to your pricing or production processes, weigh the potential costs and benefits.

Contribution margin compared to gross profit margin

Thus, at the 5,000 unit level, there is a profit of $20,000 (2,000 units above break-even point x $10). As a manager, you may be asked to negotiate or talk with vendors and perhaps even to ask for discounts. Small differences in prices of your supplies can make a huge difference in the profitability of a company. This is one reason economies of scale are so popular and effective; at a certain point, even expensive products can become profitable if you make and sell enough. A good contribution margin is all relative, depending on the nature of the company, its expense structure, and whether the company is competitive with its business peers. The contribution margin is given as a currency, while the ratio is presented as a percentage.

It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. Fixed costs are costs that are incurred independent of how much is sold or produced.

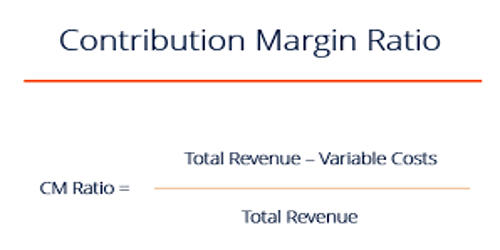

Contribution Margin Ratio Formula

This means Dobson books company would either have to reduce its fixed expenses by $30,000. On the other hand, net sales revenue refers to the total receipts from the sale of goods and services after deducting sales return and allowances. As you can see, the net profit has increased from $1.50 to $6.50 when the packets sold increased from 1000 to 2000. However, the contribution margin for selling 2000 packets of whole wheat bread would be as follows. As a business owner, you need to understand certain fundamental financial ratios to manage your business efficiently.

You can calculate the contribution margin by subtracting the direct variable costs from the sales revenue. The difference between the selling price and variable cost is a contribution, which may also be known as gross margin. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. In accounting, contribution margin is the difference between the revenue and the variable costs of a product.

Reduce variable costs by getting better deals on raw materials, packaging, and shipping, finding cheaper materials or alternatives, or reducing labor costs and time by improving efficiency. It includes the rent for your building, property taxes, the cost of buying machinery and other assets, and insurance costs. Whether you sell millions of your products or 10s of your products, these expenses remain the same. Knowing how to calculate the contribution margin is an invaluable skill for managers, as using it allows for the easy computation of break-evens and target income sales. This, in turn, can help people make better decisions regarding product & service pricing, product lines, and sales commissions or bonuses. The difference between variable costs and fixed costs is as follows.

- Thus, the level of production along with the contribution margin are essential factors in developing your business.

- This means that $15 is the remaining profit that you can use to cover the fixed cost of manufacturing umbrellas.

- The contribution margin can be presented in dollars or as a percentage.

- It’s how valuable the sale of a specific product or product line is.

- Further, it also helps in determining profit generated through selling your products.

When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment. The contribution margin ratio takes the analysis a step further to show the percentage of each unit sale that contributes to covering the company’s variable costs and profit.

A company has revenues of $50 million, the cost of goods sold is $20 million, marketing is $5 million, product delivery fees are $5 million, and fixed costs are $10 million. The contribution margin may also be expressed as fixed costs plus the amount of profit. To cover the company’s fixed cost, this portion of the revenue is available.

However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. Investors and analysts may also attempt to calculate the contribution what are real estate transfer taxes margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage.