For both basic EPS and diluted EPS, the earnings figure should be the same. A basic share count equals the average count of only the shares that are issued and outstanding during the period. Another consideration for basic EPS is its deviation from diluted EPS. If the two EPS measures are increasingly different, it may show that there is a high potential for current common shareholders to be diluted in the future. The earnings per share calculation is a valuation metric that allows investors to look at a company’s profits per share. With a little back-of-the-napkin math, investors can judge whether the stock is “cheap” or “expensive” based on how much income it generates on a per-share basis.

Diluted Earnings Per Share

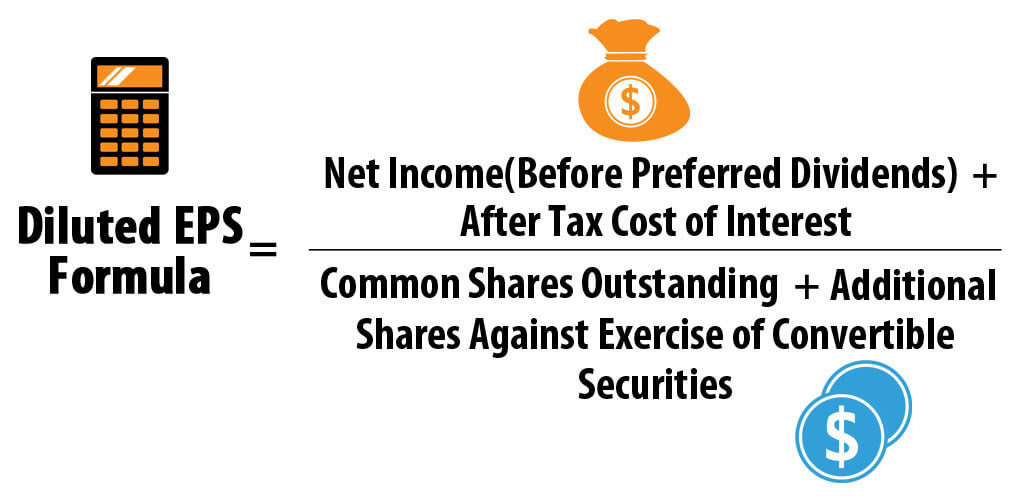

An important aspect of EPS that is often ignored is the capital that is required to generate the earnings (net income) in the calculation. A metric that can be used to identify more efficient companies is the return on equity (ROE). To better illustrate the effects of additional securities on per-share earnings, companies also report the diluted EPS, which assumes that all shares that could be outstanding have been issued.

What is Basic and Diluted EPS?

You should take into account all of the financial information available to make an investment decision. Earnings per share means the money you would earn for owning each share of common stock. A higher earning per share indicates that a company has better profitability.

How to calculate the EPS growth?

Pro forma earnings per share is a measure of a company’s profitability that excludes one-time or non-recurring items. This allows investors to get a more accurate picture of the company’s true profitability. Reported earnings per share, on the other hand, includes all items that are reported on the income statement. To calculate a company’s earnings per share, take a company’s net income and subtract from that preferred dividend.

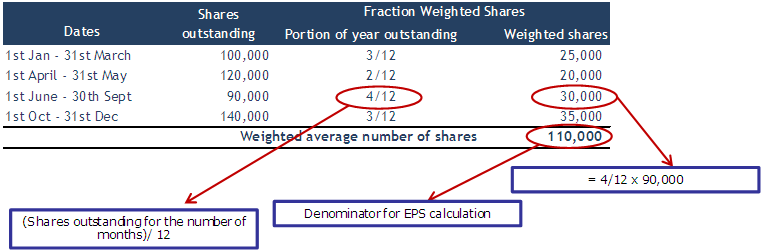

Of course, no metric is perfect on its own, and EPS has flaws, but more on that later. Earnings Per Share (EPS) is calculated by subtracting any preferred dividends from the net income and dividing by the number of outstanding shares. Throughout fiscal year 2021, the company issued no new shares and repurchased 20 million shares, resulting in 140 million common shares outstanding at the end of the period.

Diluted Earnings Per Share Formula

As with any fundamental metric, earnings per share on its own doesn’t define whether a stock is a buy or sell. Given the limitations of the EPS method, it is advisable that this method should not be used in isolation. Nonetheless, EPS is one of the most important ways to measure a company’s profitability. Investors looking to buy stocks should take advantage of using this method and the EPS calculator. EPS is used to show how much money a company makes for each share of its stock. A higher EPS is an indicator of more value as it means the company is making profits.

- Both metrics can be used to understand the fair value of a stock — but from very different perspectives.

- Common shareholders have voting rights to elect the Board of Directors and pass (or reject) corporate policies brought to vote by shareowners.

- Bank of America (BAC), for example, is in the financial services sector.

But can you guess how much your initial investment could have grown since 2011? A thousand dollars average invested in Apple stock would have returned approximately 11,000 USD in 2021. A company that can only sustain 20% EPS CAGR over three years and then stagnates is at an inferior level compared to a company that can sustain 15% EPS CAGR over five years. Calculating 5 tax deductions when selling a home EPS growth is critical for investors since it can determine if the company is undervalued or overvalued. One of the methods that includes the EPS growth rate is the PEG ratio. As an investor, it is important to be aware of these practices and to understand a company’s financial statements in order to get an accurate picture of its profitability.

Oftentimes, those who hold a preferred cumulative share are given some form of compensation for the unreasonable delay in receiving their dividends. If a firm goes bankrupt due to bankruptcy, common stockholders receive nothing. This net profit is sometimes referred to as the bottom line or simply profit. It is one of the most important pieces of financial information about a company because it signals whether that business is making money or running at a loss. What counts as a good EPS will depend on factors such as the recent performance of the company, the performance of its competitors, and the expectations of the analysts who follow the stock. Sometimes, a company might report growing EPS, but the stock might decline in price if analysts were expecting an even higher number.

This money has to cover manufacturing costs, selling costs, etc., to be called a profit. Earnings or profits are the money left after covering all expenses related to business operation, all money needed to produce the goods sold, taxes, and any interests from debts. In a nutshell, earnings are the money left after paying for the operations and any other financial obligation. To clearly understand the meaning of EPS growth meaning, you have to picture a business like a machine in which you put capital (ideally, only once). From such profits, the business needs resources for paying off debts, expanding its operations, and paying dividends to the owners, among other activities.